Top 5 Promising Stocks to Hold for the Next 4 Years

Investing in stocks with long-term growth potential can help build wealth and achieve financial security. The stock market offers a range of opportunities, and choosing the right companies to invest in can make all the difference.

Whether you’re a seasoned investor or just starting, understanding the value of long-term investing is critical. Here, we’ll explore five promising stocks that could deliver substantial returns over the next four years based on their market positioning, growth potential, and innovative strategies.

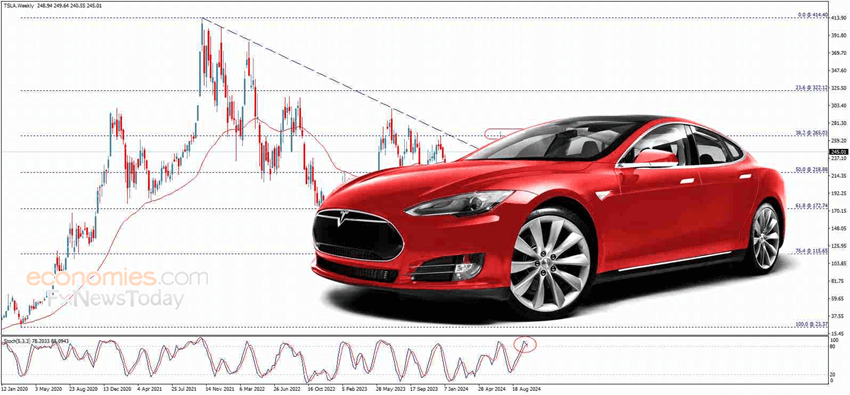

Tesla, Inc. (TSLA)

Tesla has become synonymous with electric vehicles (EVs) and renewable energy solutions. With governments worldwide pushing for sustainability and the reduction of carbon emissions, Tesla is poised to remain a dominant player in the EV market. The company’s innovations in energy storage and autonomous driving technology only add to its appeal.

Tesla has consistently increased its production capacity, with Gigafactories located in strategic regions such as China, Europe, and the United States. Its focus on reducing manufacturing costs while maintaining quality enables it to maintain a competitive edge. Beyond vehicles, Tesla’s advancements in solar panels and battery storage solutions, like the Powerwall, are positioning the company as a leader in clean energy innovation.

The EV market is expected to grow significantly over the next decade, and Tesla’s ability to innovate and adapt ensures its place as a frontrunner. However, investors should keep an eye on rising competition from both legacy automakers and new entrants into the market.

Amazon.com, Inc. (AMZN)

Amazon is much more than an e-commerce platform. The company has diversified its revenue streams through Amazon Web Services (AWS), digital advertising, subscription services like Prime, and even healthcare. AWS remains the most profitable division of Amazon, powering a significant portion of the internet and offering unparalleled scalability for businesses worldwide.

The company’s relentless focus on customer satisfaction and operational efficiency continues to drive growth. Amazon’s logistics network, investments in artificial intelligence, and expansion into global markets make it a strong contender for long-term investment.

Over the next four years, Amazon’s growing influence in industries like healthcare and entertainment could significantly boost its valuation. For instance, its recent ventures into telehealth services and pharmacy delivery reflect its ability to adapt to changing consumer needs.

Investors should note that regulatory scrutiny over antitrust concerns could pose challenges. However, Amazon’s ability to innovate and expand into new markets should offset these risks.

NVIDIA Corporation (NVDA)

NVIDIA has established itself as a global leader in graphics processing units (GPUs), which are critical for gaming, artificial intelligence (AI), data centers, and more. The company’s cutting-edge technology has become essential for industries relying on high-performance computing.

As AI adoption accelerates across sectors, NVIDIA is poised to benefit significantly. Its GPUs are the backbone of AI training models, making the company indispensable for organizations investing in AI capabilities. Additionally, NVIDIA’s role in powering autonomous vehicles, virtual reality, and the metaverse opens up new avenues for growth.

The gaming industry, which has been a core market for NVIDIA, continues to expand, fueled by advancements in hardware and the growing popularity of esports. Furthermore, data centers are increasingly reliant on NVIDIA’s GPUs for efficiency and scalability.

Investors should consider the company’s consistent innovation and strong market position. However, fluctuations in demand for gaming hardware and potential supply chain issues in the semiconductor industry are risks to monitor.

Alphabet Inc. (GOOGL)

Alphabet, the parent company of Google, is an essential player in the tech industry with diverse revenue streams. The company’s core business in digital advertising dominates the market, while its ventures into cloud computing, autonomous driving, and artificial intelligence ensure its relevance for years to come.

Google Cloud continues to expand rapidly as businesses worldwide migrate to the cloud. This division is a key growth driver for Alphabet, offering significant revenue potential. Additionally, YouTube remains a critical platform for video content and advertising, attracting billions of users globally.

Alphabet’s investments in Waymo, its autonomous driving division, could revolutionize transportation and open up new revenue streams. Its advancements in AI through DeepMind and other projects demonstrate the company’s commitment to staying at the forefront of innovation.

While Alphabet faces regulatory challenges, especially regarding antitrust issues, its diversified portfolio and strong cash flow make it a reliable choice for long-term investors.

Johnson & Johnson (JNJ)

Johnson & Johnson is a stable and diversified company that thrives in the healthcare sector. Its business spans pharmaceuticals, medical devices, and consumer health products, offering a steady revenue stream regardless of economic conditions.

The company’s pharmaceutical division is a significant growth driver, focusing on high-margin areas like oncology, immunology, and neuroscience. Additionally, Johnson & Johnson’s investment in medical devices positions it to capitalize on the increasing demand for advanced healthcare technologies.

Aging populations worldwide ensure consistent demand for healthcare products and services, making Johnson & Johnson a reliable pick for long-term investors. The company’s strong dividend history is another attractive feature, providing consistent returns even during market downturns.

However, potential legal challenges and competition from generic drug manufacturers are risks to consider. Despite these, the company’s robust pipeline and innovative approach to healthcare make it a sound investment.

Why Long-Term Investments Matter

Investing for the long term allows you to take advantage of compound growth and ride out market volatility. Companies like Tesla, Amazon, NVIDIA, Alphabet, and Johnson & Johnson have proven their ability to adapt to changing market conditions and deliver value to shareholders over time.

Diversification is key when building a portfolio. By including stocks from various industries, such as technology, healthcare, and clean energy, you reduce risk and increase the potential for consistent returns.

Regularly monitoring your investments and staying informed about market trends can help you make better decisions. Long-term success also requires patience and discipline, as markets will inevitably experience fluctuations.

Final Thoughts

The next four years offer significant opportunities for investors willing to focus on growth-oriented stocks. Tesla’s innovation in EVs, Amazon’s dominance in e-commerce and cloud computing, NVIDIA’s leadership in AI and gaming, Alphabet’s expansive tech portfolio, and Johnson & Johnson’s stability in healthcare make these stocks worthy of consideration.

Remember to assess your financial goals, risk tolerance, and time horizon before investing. While these companies show promise, all investments carry risks, and past performance is not a guarantee of future results. Diversify, stay informed, and take a proactive approach to building your wealth. With careful planning and strategic choices, you can set yourself up for long-term success.